The City of Burnaby says expenses connected to property tax appeals went down in 2021 while property assessment values have rapidly increased.

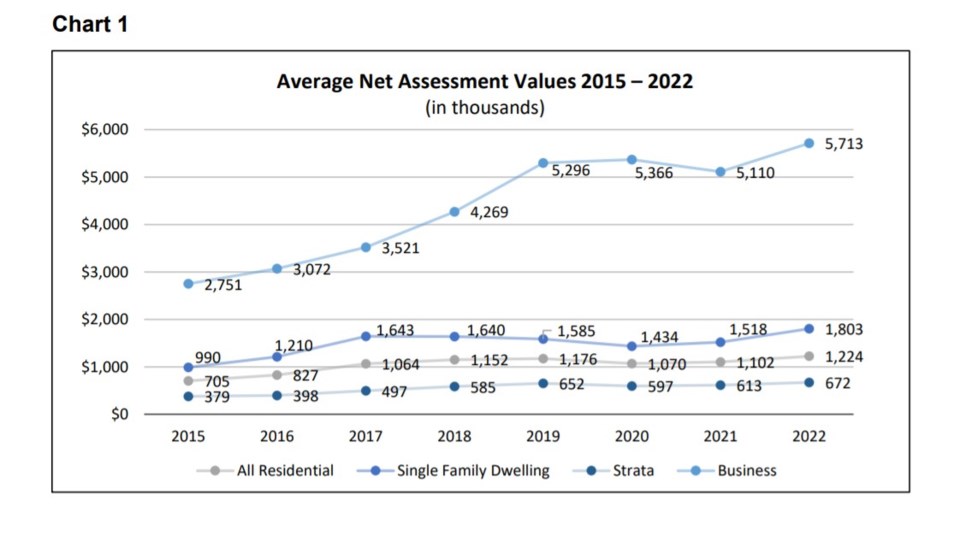

According to a report presented at the Jan. 24 council meeting, city staff said that, for 2022, they are seeing large increases in assessment values across all property classifications, which includes residential, single family dwelling, strata and business.

The report says businesses are seeing the biggest rise.

Average assessment increases for 2022 in Burnaby are as follows:

- Average residential property

- 2021 assessment - $1,082,682

- 2022 assessment - $1,224,096

- Average increase: 13.06%

- Single family dwelling

- 2021 assessment - $1,523,022

- 2022 assessment - $1,803,044

- Average increase: 18.39%

- Strata/Mixed family

- 2021 assessment - $618,832

- 2022 assessment - $671,974

- Average increase: 8.59%

- Utilities

- 2021 assessment - $1,863,657

- 2022 assessment - $2,360,087

- Average increase: 26.64%

- Major industry

- 2021 assessment - $19,600,200

- 2022 assessment - $24,060,941

- Average increase: 22.67%

- Light industry

- 2021 assessment - $8,026,869

- 2022 assessment - $9,888,426

- Average increase: 23.19%

- Business

- 2021 assessment $4,982,825

- 2022 assessment - $5,712,785

- Average increase: 14.65%

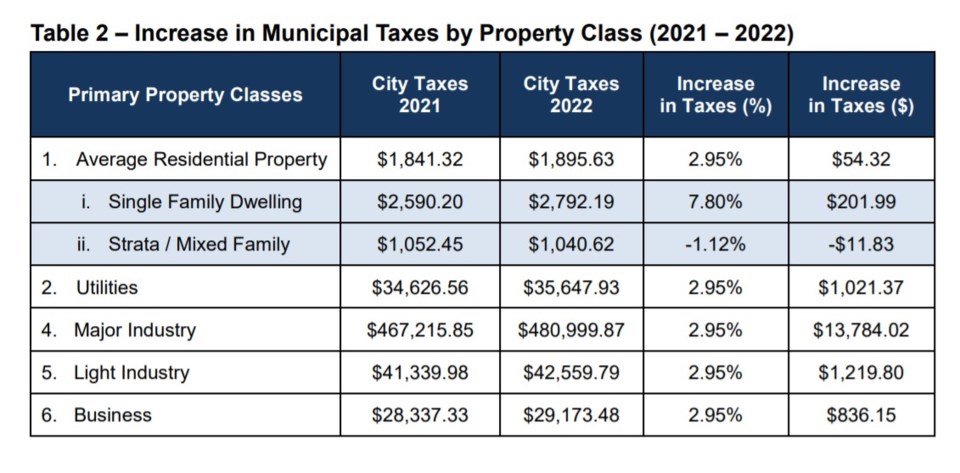

The city adds owners of single family dwellings experience an assessment increase of roughly 19%, which has led to a tax increase for 2022 of 7.80% or $201.99.

Property owners who don't agree with the values assigned by the BC Assessment Authority (BCA) are allowed to appeal to the Property Assessment Review Panel for 2022 by Jan. 31, 2022.

The second level of appeal is the Property Assessment Appeal Board (PAAB). The deadline to file an appeal through this channel is April 30 of each year.

The BC Assessment Authority gives municipalities a Risk to Roll report in early July which captures all appeals submitted to the PAAB, providing an update on their status.

In 2021, the PAAB says they received 4,427 appeals for both residential and commercial properties, with 97% completed, withdrawn or heard by the board.

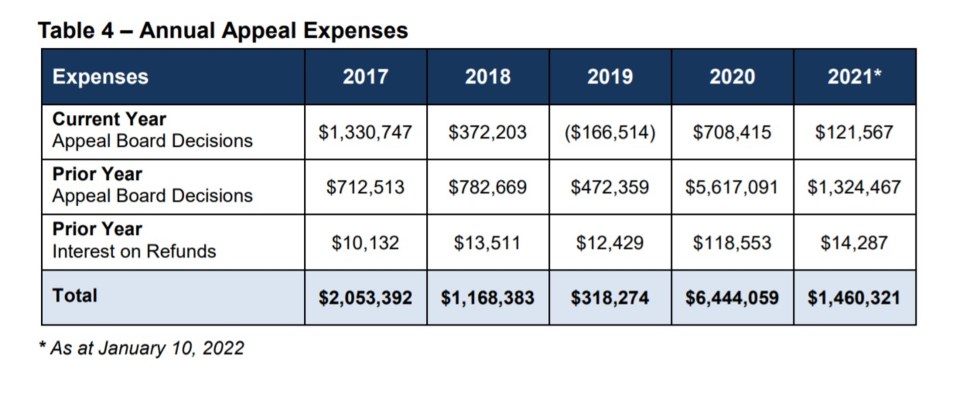

City of Burnaby appeal costs for 2017 to 2021 are as follows, with last year seeing a sharp drop:

- 2017

- Current Year (Appeal Board Decisions) - $1,330,747

- Prior Year (Appeal Board Decisions) - $712,513

- Prior Year (Interest on refunds) - $10,132

- Total: $2,053,392

- 2018

- Current Year (Appeal Board Decisions) - $372,203

- Prior Year (Appeal Board Decisions) - $782,669

- Prior Year (Interest on refunds) - $13,511

- Total: $1,168,383

- 2019

- Current Year (Appeal Board Decisions) - ($166,515)

- Prior Year (Appeal Board Decisions) - $472,359

- Prior Year (Interest on refunds) - $12,429

- Total: $318,274

- 2020

- Current Year (Appeal Board Decisions) - $708,415

- Prior Year (Appeal Board Decisions) - $5,617,091

- Prior Year (Interest on refunds) - $118,553

- Total: $6,444,059

- 2021

- Current Year (Appeal Board Decisions) - $121,567

- Prior Year (Appeal Board Decisions) - $1,324,467

- Prior Year (Interest on refunds) - $14,287

- Total: $1,460,321

The full report is available to view online.