Each month in this column I write about a topic which is important to local businesses and top of mind at the Burnaby Board of Trade.

Lately, there is nothing that’s been getting our members talking more than the release of BC Assessment’s property valuations for 2019 and what they might mean for property taxes.

For homeowners, getting your property assessment in recent years has been akin to getting a winning lottery ticket - soaring property values have allowed many homeowners to amass considerable equity in their homes. For business owners, however, assessments in recent years have been more like opening the credit card bill after Christmas.

That’s because property tax is charged based on the value of a property, so significant increases in the value of their property can lead to big property tax bills down the road.

I’ve heard from businesses who have seen 100-, 200- or even more than 300-per-cent increases in their property values recently, which likely means they will be facing significantly increased tax bills later this year. These can reach into the tens or even hundreds of thousands of dollars. For many businesses, a sudden increase in expenses on that scale can be a real hardship, and unfortunately some are forced to sell, relocate or close down as a result.

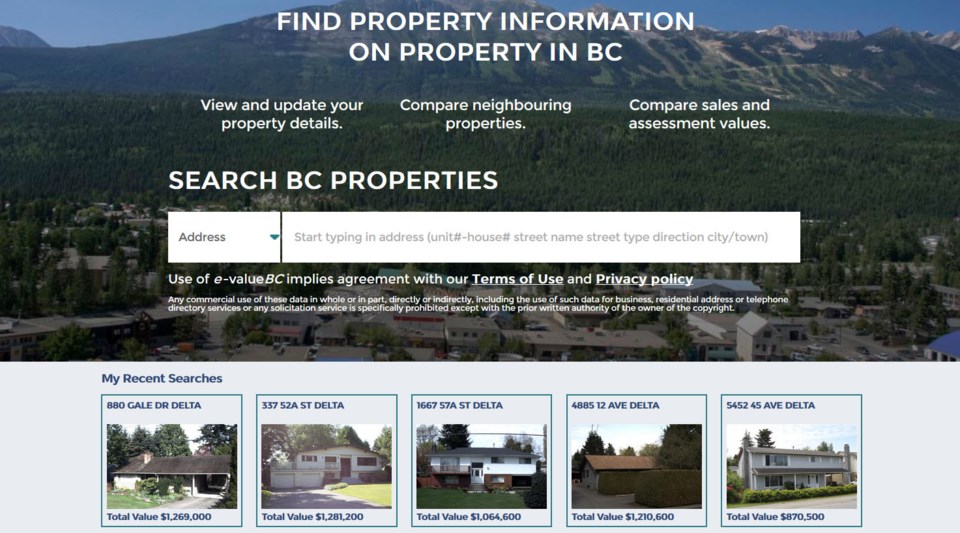

The crux of this problem is in how BC Assessment, the body responsible for property valuations, determines a property’s worth.

Instead of looking at what a property is today (a corner store, a small strip mall), it considers the property’s “highest and best use” or what could potentially be built there instead. In a thriving and growing city like Burnaby, many properties have redevelopment potential which causes values to soar, even if there are no actual plans to redevelop the property and there have been no changes in zoning. All of this means that the local butcher, green grocer, or mechanic shop may be taxed not on what they use the property for now, but on the condo tower or office building which could potentially replace them in the future.

This has long been an irritant for businesses, but with the rapid appreciation of properties throughout the region, the time has come to fix it.

This is why the Burnaby Board of Trade has developed a series of solutions which we will work with government to advance. These include considering what commercial properties are actually being used for when determining their taxable value and reducing the impact of “highest and best use.” We also will propose offering businesses similar exemptions and deferrals that homeowners currently enjoy, and making tax increases more gradual to help local businesses weather sudden and significant property value and tax increases.

Local businesses play a critical role in our communities by providing employment, generating economic growth, and contributing to the character of our neighbourhoods. I believe they need to be supported and protected from being forced out simply because of taxation.

Based on the buzz around the business community, I’m not the only one who thinks so.

Paul Holden is CEO of the Burnaby Board of Trade. His column appears monthly in the Burnaby NOW.