WASHINGTON (AP) — President Donald Trump returned to the White House in January determined to overturn decades of American policy and build a tariff wall around a U.S. economy that used to be pretty much wide open to foreign products.

In the process of making that a reality, he has rattled financial markets and worried consumers with an ever-changing lineup of import taxes. The pattern goes something like this: He'll announce new tariffs, then suspend them, then come up with new ones. The uncertainty has paralyzed businesses who don't know what to expect. And economists worry that the tariffs will push up prices and hurt economic growth.

Trump says the tariffs will protect American industry, lure factories back to the United States and raise money for the federal government.

But a court case this week has raised doubts about how far he can go in asserting his power to tax imports.

The Associated Press asked for your questions about Trump's tariffs. Here are a few of them, along with our answers:

Can Trump impose tariffs without congressional approval?

The U.S. Constitution gives Congress the power to establish taxes. That includes tariffs, which are just a tax on imports. Over the years, however, Congress has ceded some authority to impose tariffs to the president under various laws.

For example, Section 232 of the Trade Expansion Act of 1962 allows the president to slap taxes on imports that he says pose a threat to national security. Trump used Section 232 to impose tariffs on imported steel and aluminum in his first term and on cars and auto parts in his second. But Section 232 requires a Commerce Department investigation, which takes time.

Likewise, Section 301 of the Trade Act of 1974 allows the president to tax imports from countries found to have engaged in unfair trade practices after an investigation by the Office of the U.S. Trade Representative. Trump used Section 301 in his first term to impose tariffs on China in a dispute over Beijing's sharp-elbowed attempts to challenge U.S. technological supremacy through tactics such as subsidizing Chinese firms and forcing U.S. companies to hand over trade secrets.

Trump wanted to move faster after he returned to the White House in January. So he reached for the power to impose tariffs himself without waiting around. He turned to the International Emergency Economic Powers Act (IEEPA) of 1977, arguing that the law allowed him to declare a national emergency and impose tariffs to address it.

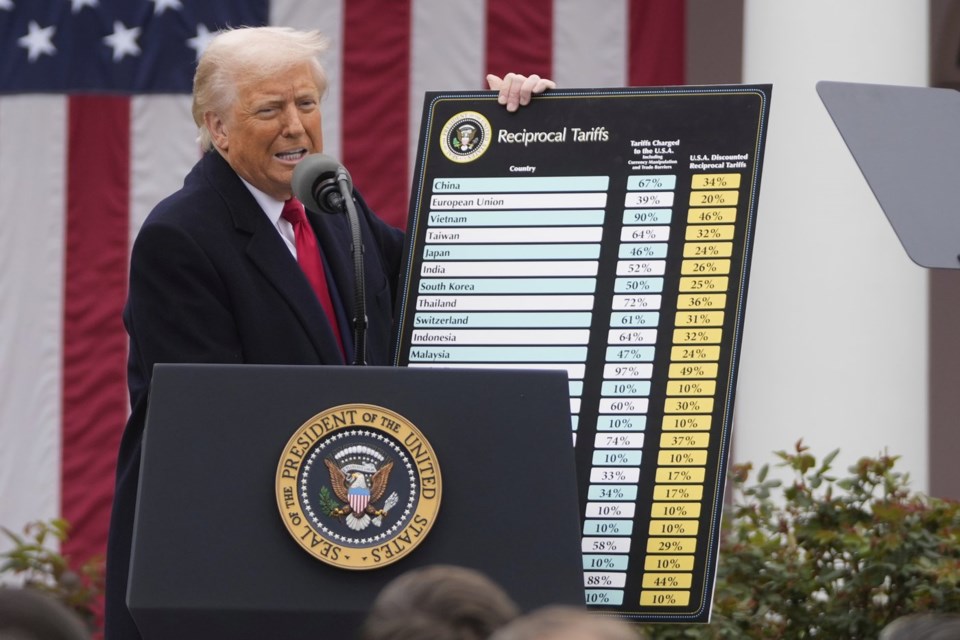

So in February he declared the illegal flow of immigrants and drugs an emergency and used it to justify tariffs on Canada, China and Mexico. Then last month he declared America's long-running trade deficits an emergency and imposed tariffs on almost every country in the world.

At least seven lawsuits are challenging his use of that power. And on Wednesday the U.S. Court of International Trade blocked Trump's IEEPA tariffs, ruling that he'd overstepped his authority.

The emergency powers act, the three-judge panel declared, did not allow the use of global tariffs. Moreover, it said, the tariffs did not address the problems the president had identified. The Trump administration has appealed the ruling, and a federal appeals court on Thursday allowed the government to continue collecting the IEEPA import taxes while the appeals continue.

Congress has made some motion toward reasserting its authority. Republican Sen. Chuck Grassley of Iowa and Democratic Sen. Maria Cantwell of Washington, for instance, have introduced legislation that would require presidents to justify new tariffs to Congress. Lawmakers would then have 60 days to approve the tariffs. Otherwise, they would expire.

But their proposal appears to stand little chance of becoming law, given most Republican lawmakers’ deference to Trump and the president’s veto power.

Can Trump use other laws to impose tariffs?

Yes, and some of his top aides swiftly promised to do so. Still, to do it legally will take longer and he may not be able to reinstate every duty that he previously imposed, or threatened to impose.

In fact, the court laid out a bit of a road map, pointing out that if Trump wanted to impose duties to reduce U.S. trade deficits, he should use a different law that was expressly intended for that purpose — specifically, Section 122 of the Trade Act of 1974. Yet that law only allows tariffs of up to 15% for 150 days.

The broader point of the court's ruling is that since Congress has the power to impose tariffs under the Constitution, it can only delegate that power to the president under specific laws the president has to follow.

There are several Trump could use, including Section 301 of the 1974 Trade Act, but that does require an investigation of another country's trade practices to establish that they either violated a trade agreement or engaged in unfair trade practices.

Another possibility is Section 338 of the Trade Act of 1930, which allows tariffs of up to 50% for countries that have discriminated against U.S. imports. It doesn't require a government agency to investigate anything. And Section 201 of the 1974 Trade Act allows duties to be imposed of up to 50%, but only after an investigation that establishes that imports have harmed a specific U.S. industry. That law was used to slap tariffs on some solar products in 2018.

Where is the money collected by the tariffs going?

If the courts uphold Wednesday's ruling and the import taxes are struck down, the money will be refunded back to the U.S. companies that paid it.

Otherwise, it goes to the U.S. Treasury, like personal and corporate income taxes, to pay for government expenses. Tariff revenue collections have spiked in recent months, and were on track to reach about $22 billion in May. That is up from $6 billion in February, before most tariffs were imposed. Economists at Nomura Securities estimate that the tariffs struck down by the court have raised a total of about $40 billion to $60 billion so far.

Paul Wiseman And Christopher Rugaber, The Associated Press